How long does it take to get an EIN?

See how long other business owners are waiting to receive their EIN. This page is updated weekly.

Latest EIN wait times

We ask recent EIN applicants how many days it took to receive their EIN. See how long it takes to receive an EIN and view timelines from other applicants.

Non-US residents

US residents applying with SSN

Submit your EIN wait time

How long did it take to get your EIN? Help keep our EIN processing timelines as accurate as possible and help other EIN applicants.

EIN application wait times

EIN processing times depend on the application method and IRS workload. Online applications are instant, faxed ones take days to weeks, and mailed requests can take over a month. High demand, errors, and extra verification for international applicants can cause delays.

EIN Guides & Business Resources

Stay updated with the latest EIN processing insights, LLC formation guides, and practical advice for starting your US business.

The Ultimate Guide to Forming a US LLC for Non-Residents in 2025

Every year, thousands of global business owners set their sights on the United States, one of the...

How to Get an EIN for a Foreign-Owned LLC (Without an SSN or ITIN)

Starting a business in the US as a non-resident can be exciting, but also a little confusing, especially...

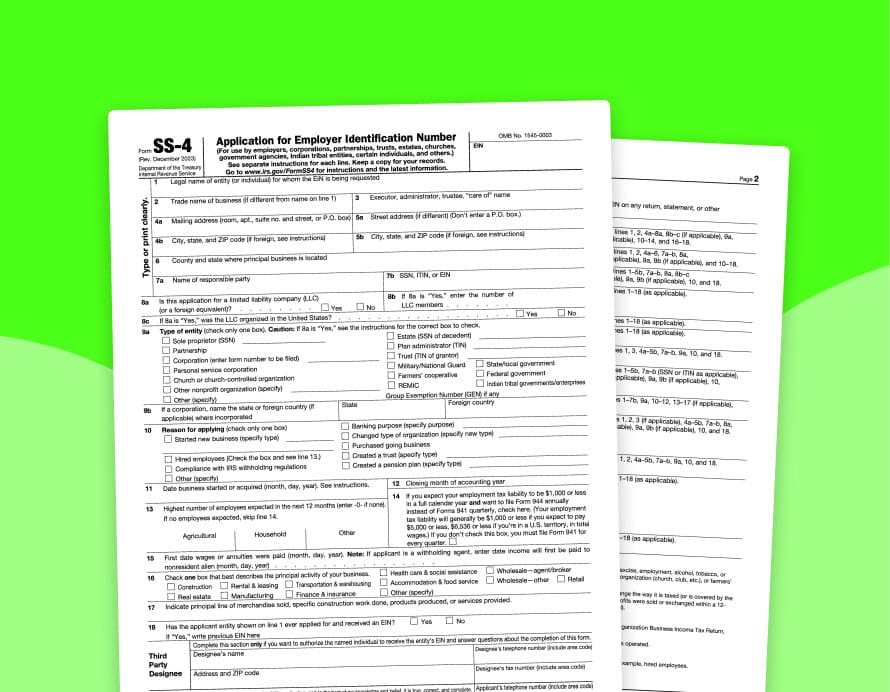

A Step-by-Step Guide to Filling Out Form SS-4 for Foreigners

Filling out IRS paperwork as a non-US resident can feel overwhelming at times, especially when you’re faced with...

How to Open a US Bank Account as a Foreigner

Opening a US bank account as a foreign business owner might seem intimidating, but it’s more doable than you think....

Submit your EIN processing time

The more information we have, the better we can help others understand realistic EIN processing timeframes. If you’ve successfully obtained your EIN, we’d greatly appreciate it if you could share how long the process took using our quick form.

For those interested in receiving valuable tools and resources and being entered into a draw for a $100 Amazon gift card, feel free to include your email address (completely optional).

We appreciate your contribution to helping fellow entrepreneurs!